Special Offer: Take Advantage of North Dakota’s 50% REAP Grant Today

Estimated Solar Power Costs in North Dakota

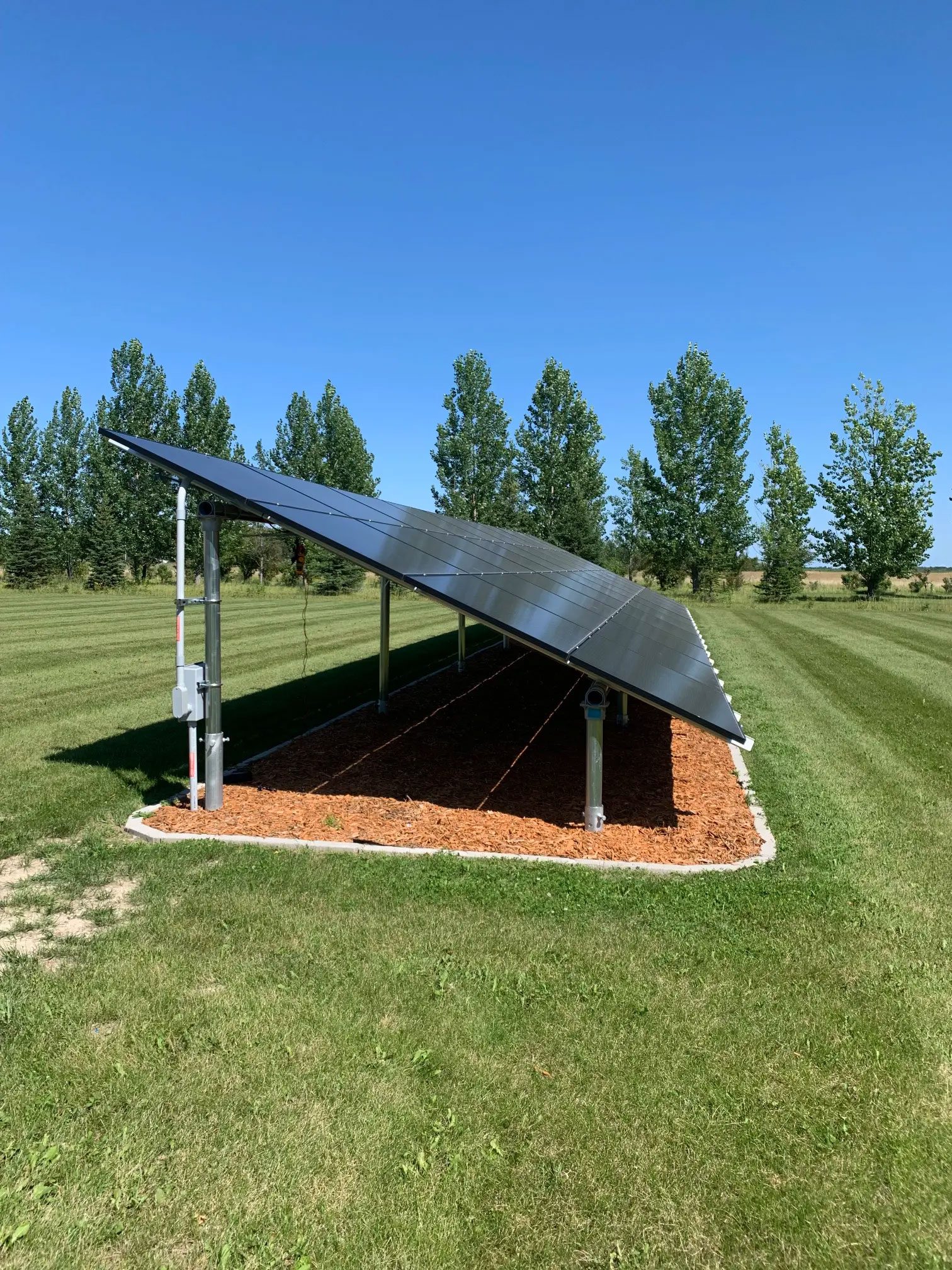

The choice to go solar has become increasingly popular among businesses and homeowners, offering substantial savings when equipped with the right system. But what are the estimated solar power costs for different monthly bill rates?

Both businesses and individuals can make the most of the 30% tax credit available for solar panel system installations. Additionally, farms and large businesses may be eligible for the 50% REAP grant, further reducing the cost of solar systems and making them more affordable.

In conclusion, estimated pricing for solar power varies significantly depending on factors such as system type, installation costs, and the number of panels required. However, with the right equipment and the availability of tax credits and grants, transitioning to solar power can be a cost-effective means of reducing monthly bills.

Frequently Asked Questions

1. How can I know how much my business will save?

We offer a free consultation, and our account managers will put together the exact savings your business will yield with solar energy. They will be in touch if they need more energy bill information.

2. Is there an upfront cost?

Yes and no. Whether there is an upfront cost depends on your choice of financing your system. If you choose to spread the upfront cost with a loan, the energy savings are often greater than the repayments, so you can get a solar panel system right away without needing to pay anything upfront. You can also choose to pay the upfront cost.

We also have power purchase agreements available, which have no upfront cost. Please ask for more information.

3. Are there grants and rebates available?

Yes. We will take care of all available grants and rebates for you and incorporate them into your proposal.

4. What tax credits am I eligible for?

The federal residential solar energy credit can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer. (Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance.)

Solar PV systems installed in 2020 and 2021 are eligible for a 26% tax credit. In August 2022, Congress passed an extension of the International Trade Commission (ITC), raising the tax credit to 30% for the installation done between 2022 and 2032. (Systems installed on or before December 31, 2019, were also eligible for a 30% tax credit.)

This will decrease to 26% for systems installed in 2033 and to 22% for systems installed in 2034. The tax credit expires starting in 2035 unless Congress renews it. There is no maximum amount that can be claimed.

1. How can I know how much my business will save?

We offer a free consultation, and our account managers will put together the exact savings your business will yield with solar energy. They will be in touch if they need more energy bill information.

2. Is there an upfront cost?

Yes and no. Whether there is an upfront cost depends on your choice of financing your system. If you choose to spread the upfront cost with a loan, the energy savings are often greater than the repayments, so you can get a solar panel system right away without needing to pay anything upfront. You can also choose to pay the upfront cost.

We also have power purchase agreements available, which have no upfront cost. Please ask for more information.

3. Are there grants and rebates available?

Yes. We will take care of all available grants and rebates for you and incorporate them into your proposal.

4. What tax credits am I eligible for?

The federal residential solar energy credit can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer. (Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance.)

Solar PV systems installed in 2020 and 2021 are eligible for a 26% tax credit. In August 2022, Congress passed an extension of the International Trade Commission (ITC), raising the tax credit to 30% for the installation done between 2022 and 2032. (Systems installed on or before December 31, 2019, were also eligible for a 30% tax credit.)

This will decrease to 26% for systems installed in 2033 and to 22% for systems installed in 2034. The tax credit expires starting in 2035 unless Congress renews it. There is no maximum amount that can be claimed.

Request a Quote

Get Started Today

When you are ready to maximize your savings, let our team provide you with a customized quote. We’ve been serving residential and commercial clients in North Dakota since 2007, marked by our exceptional workmanship, seamless installation process, and excellent customer service.

Let us help you cut thousands of dollars in electricity costs today. Take advantage of our free consultation and discover why our best-in-class solar panels are a smart investment for a sustainable future.

Authorized Clean Energy Dealer and Installer of Generac Power Systems

Wind & Solar World sells, installs, and services the Generac PWRcell line of clean energy backup products. Contact us for details.